Today, we’re taking an in-depth look at ING Group, a major player in the financial sector listed on the Euronext Amsterdam exchange under the ticker symbol INGA. As a significant entity in the banking and financial services industry, ING Group offers a diverse range of products and has a substantial market presence. Let’s delve into the specifics of its stock performance, dividend history, overall company profile, valuation, and more to provide a comprehensive overview.

Stock Performance and Dividends

As of the latest data, ING Group’s stock is trading at approximately €15 per share. The bank is known for its bi-annual dividend payouts, which are an attractive feature for income-focused investors. The most recent dividend payments were €0.35 and €0.389 per share. Looking ahead, the next ex-dividend date is set for April 24th, with the dividend payout scheduled for May 3rd. Currently, the dividend yield stands at a robust 6.2%, which is quite appealing in today’s low-interest-rate environment.

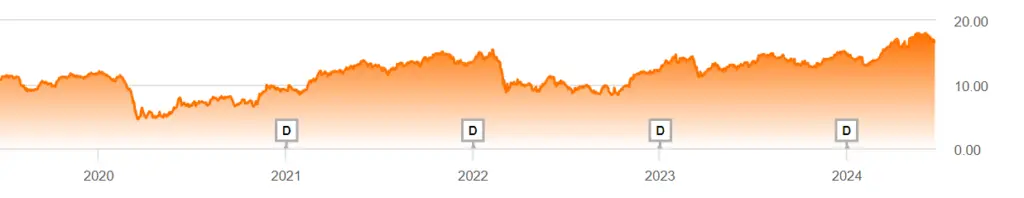

I began a small position in ING Group on June 21, 2021. Since then, my investment has grown by approximately 35%. During this period, I have received €0.88 in dividends and have not yet seen any returns of capital. Despite some short-term fluctuations—down 3% in the past five days and 5% over the past month—the stock has demonstrated long-term resilience. Over the past six months, the stock is up 2%; over the past year, it’s up 4%; and over the past five years, it has appreciated by about 30-31%. Since its inception in 1991, the stock has grown by roughly 140% from its levels in 1995.

Overview of ING Group

Founded in 1991 and headquartered in Amsterdam, ING Group is a prominent Dutch multinational banking and financial services corporation. This company has grown to employ approximately 60,000 people worldwide, reflecting its significant footprint in the financial industry. ING Group offers a comprehensive suite of financial services including lending, mortgages, savings accounts, real estate, and leasing. The bank operates in multiple countries with notable sections in the Netherlands, Belgium, Germany, and Australia.

With a market capitalization of €45.5 billion, ING Group is classified as a large-cap stock. This categorization underscores its substantial size and influence in the financial market. Analyst opinions on ING Group vary: Reuters rates it just above a hold based on four analyst ratings, while MarketScreener suggests a moderate buy based on 22 ratings. Yahoo Finance assigns it a 2.7 out of 5, indicating a slight preference above hold. Meanwhile, the Wall Street Journal leans towards a buy, with 14 buy ratings, six hold ratings, one underweight rating, and one sell rating. The high price target for ING Group is €18.10, the median price target is €16.45, and the low price target is €15.00—close to its current trading price. Investing.com supports an outperform rating with an average price target of €16.38, reflecting a potential 27.7% upside.

Valuation Insights

Valuation is a critical aspect of understanding a company’s financial health and future prospects. For the third quarter of the previous year, ING Group reported revenue of approximately €5.5 billion, representing a 40% increase year-on-year. Their net income was around €2 billion, a substantial 102% increase year-on-year. The net profit margin stood at 35%, up 45%, and their operating income was €2.9 billion, up 101%. These figures collectively earned ING Group a solid score in terms of valuation.

The company’s current earnings per share (EPS) is €19, with a trailing price-to-earnings (P/E) ratio of 6.81 and a forward P/E ratio of 6.56. Both ratios are below the industry average, indicating that the stock is currently trading at a reasonable price. However, a notable concern is their debt-to-assets ratio, which stands at a high 95%. This is typical for banks, which often operate with significant leverage, but it’s still a factor that warrants attention. The cash flow situation isn’t stellar either: the annual operating cash flow is €11.1 billion, with a negative cash flow from investing at €5.3 billion, and a financing cash flow of €4.65 billion. Insider ownership is less than 1% as of June 2023, reflecting minimal internal stakes.

Dividend Analysis

One of the highlights of investing in ING Group is its dividend policy. The bank pays dividends twice per year and has also issued special dividends occasionally—two were paid in 2022. The current dividend yield is about 6.2%, with a payout ratio of approximately 72%, which is considered sustainable. However, the bank has only raised its dividends for the last two years. In 2021, it paid €0.39 per share, which increased to €0.81 in 2022 and slightly to €0.82 in 2023.

The bank has a history of nine consecutive years of dividend payments, despite interruptions during the 2008 financial crisis and the 2020 pandemic. The forward dividend yield is close to 11%, at 10.82%, although historical data on dividend growth rates is sparse due to these interruptions. This high forward dividend yield is particularly attractive, especially for income-seeking investors.

Performance Metrics and Ratings

Analyzing the performance and ratings of ING Group provides a clearer picture of its market standing. According to Reuters, ING Group is rated just above a hold based on four analyst ratings. MarketScreener offers a more favorable outlook, suggesting a moderate buy based on 22 ratings. Yahoo Finance assigns a 2.7 out of 5 rating, indicating a slight preference above hold.

The Wall Street Journal leans towards a buy, with 14 buy ratings, six hold ratings, one underweight rating, and one sell rating. The high price target for ING Group is €18.10, the median price target is €16.45, and the low price target is €15.00, which is close to its current trading price. Investing.com also supports an outperform rating with an average price target of €16.38, reflecting a potential 27.7% upside. These ratings and performance metrics highlight a generally positive outlook for the bank, despite some areas of concern.

Financial Health and Prospects

In the third quarter of the previous year, ING Group reported revenue of approximately €5.5 billion, marking a 40% increase year-on-year. Their net income was around €2 billion, a substantial 102% increase year-on-year. The net profit margin stood at 35%, up 45%, and their operating income was €2.9 billion, up 101%. These figures collectively paint a positive picture of the bank’s financial health and prospects.

However, the company’s debt-to-assets ratio of 95% is a point of concern. While high leverage is common in the banking industry, it can pose risks, especially during economic downturns. Additionally, the cash flow situation is not particularly strong. The annual operating cash flow is €11.1 billion, with a negative cash flow from investing at €5.3 billion, and a financing cash flow of €4.65 billion. These factors need to be monitored closely to ensure the bank’s long-term stability and growth.

Long-Term Growth and Market Position

Since its inception in 1991, ING Group has shown substantial growth. The stock has appreciated by roughly 140% from its levels in 1995. Over the past five years, the stock has grown by about 30-31%, reflecting its resilience and ability to adapt to changing market conditions. This long-term growth is a testament to the bank’s solid market position and strategic initiatives.

Looking ahead, ING Group’s expansion into various international markets, including Belgium, Germany, and Australia, positions it well for future growth. The bank’s comprehensive suite of financial services and its substantial market presence in these countries provide a strong foundation for continued success.

Conclusion

Overall, ING Group is a formidable player in the financial services industry. Despite some challenges, such as high leverage and a not-so-strong cash flow situation, the bank has demonstrated resilience and growth potential. The attractive dividend yield, solid market position, and positive analyst ratings make ING Group an appealing option for investors.

In conclusion, while there are better choices out there, ING Group shows signs of improvement and resilience in its operations. With a score of 10.05 out of 16.5 points, or about 61%, it is not the best but also not the worst investment option available. As with any investment, it is crucial to monitor the company’s performance and market conditions closely. Stay tuned for more updates and insights on financial market trends and individual stock analyses.