Investing in the stock market is not a one-size-fits-all endeavor. Among the myriad of strategies available to investors, two stand out for those seeking to build wealth through dividends: Dividend Growth Investing and Income Investing. While both strategies involve investing in dividend-paying stocks, they cater to different investment goals and risk appetites. This comprehensive guide delves into the pros and cons of each approach, providing critical insights to help you make an informed decision.

Understanding Dividend Strategies

Before diving into the pros and cons, it’s essential to understand what Dividend Growth Investing and Income Investing entail.

Dividend Growth Investing

Dividend Growth Investing focuses on companies that not only pay dividends but also have a history of increasing their dividend payouts over time. Investors reinvest these growing dividends to compound their returns, aiming for long-term capital appreciation and increasing income streams.

Income Investing

Income Investing, on the other hand, prioritizes companies that offer high dividend yields right now. The primary goal is to generate a steady and significant income stream, often for immediate use, such as funding retirement or covering living expenses.

Dividend Growth Investing: A Deep Dive

Pros

1. Capital Appreciation

Companies that consistently grow their dividends are often financially robust and exhibit strong fundamentals. Investing in such companies can lead to significant capital appreciation over time, as the market tends to reward consistent performers.

2. Growing Income Stream

A key advantage is the increasing dividend payments. As companies raise their dividends, investors enjoy a growing income stream, which can outpace inflation and enhance purchasing power.

3. Reinvestment and Compounding

Reinvesting dividends accelerates the compounding effect. Over the long term, this can substantially boost the total return on investment, turning modest initial investments into significant wealth.

4. Lower Risk of Dividend Cuts

Companies with a history of dividend growth are less likely to cut their dividends during economic downturns. Their commitment to maintaining and growing dividends can provide a level of income stability.

Cons

1. Lower Initial Dividend Yield

Dividend growth stocks often have lower initial yields compared to high-yield income stocks. This can be less attractive for investors seeking immediate income.

2. Market Volatility Impact

While these companies are generally stable, their stock prices can still be subject to market volatility. Investors may experience fluctuations in their portfolio value, which can be unsettling.

3. Requires Patience

The benefits of dividend growth investing compound over time. Investors need a long-term horizon to realize significant gains, which may not suit those with short-term goals.

Suitable for:

- Long-Term Investors: Those willing to invest over extended periods to maximize compounding benefits.

- Growth-Oriented Investors: Individuals who prioritize capital appreciation alongside income.

- Risk-Averse Investors: Those who prefer companies with strong financials and lower risk of dividend cuts.

Income Investing: An In-Depth Look

Pros

1. High Immediate Income

Income investing provides a higher dividend yield upfront, which is ideal for investors needing immediate cash flow, such as retirees.

2. Predictable Cash Flow

High-yield investments can offer predictable and regular income, aiding in budgeting and financial planning.

3. Diverse Investment Options

Income investors have access to various instruments beyond dividend stocks, such as bonds, REITs, and MLPs, allowing for portfolio diversification.

Cons

1. Limited Capital Appreciation

High-yield stocks may not offer significant capital growth. In some cases, the stock price may decline, eroding the total return.

2. Higher Risk of Dividend Cuts

Companies offering high yields might be doing so because of underlying financial issues. There is an increased risk of dividend reductions or eliminations.

3. Inflation Erosion

Fixed high dividends may not keep pace with inflation over time, reducing real income and purchasing power.

Suitable for:

- Retirees and Near-Retirees: Individuals who need to replace employment income.

- Income-Dependent Investors: Those relying on investment income for living expenses.

- Short-Term Investors: Individuals with shorter investment horizons seeking immediate returns.

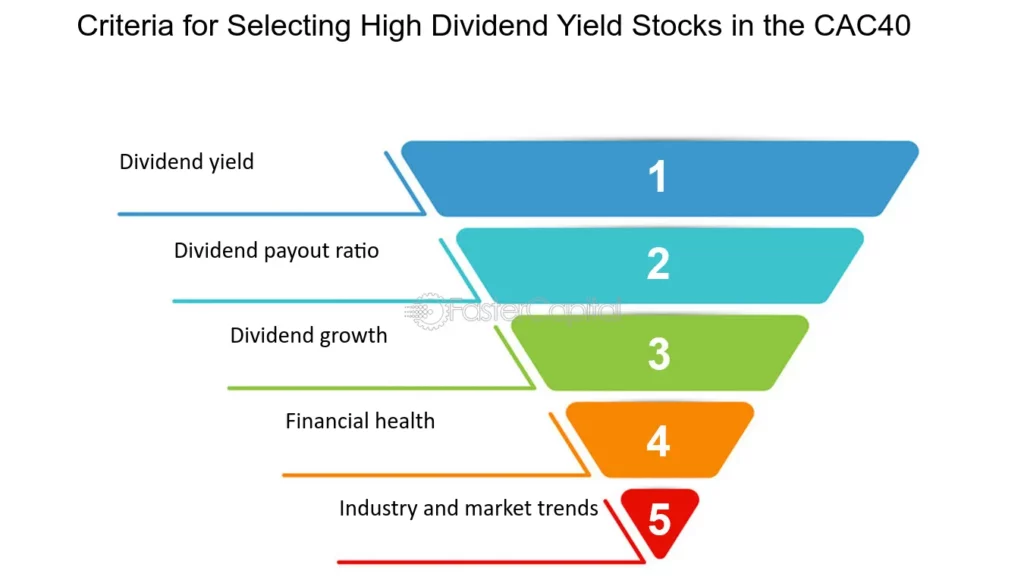

Comparative Analysis

Risk Factors

- Dividend Growth Investing: Generally involves companies with stable earnings and growth prospects, leading to potentially lower risk.

- Income Investing: High yields can be a red flag for underlying company issues, increasing investment risk.

Tax Considerations

- Qualified Dividends: Both strategies can involve qualified dividends taxed at lower rates, but high turnover in income investing might lead to higher taxes.

- Tax-Advantaged Accounts: Holding dividend-paying stocks in tax-advantaged accounts can mitigate tax liabilities.

Portfolio Diversification

- Dividend Growth Investing: May focus on blue-chip companies across various sectors, offering diversification.

- Income Investing: Often includes specialized sectors like utilities and REITs, which may lack diversification.

Market Conditions Impact

- Economic Growth: Dividend growth stocks may perform better in growing economies.

- Interest Rates: High-yield investments can be sensitive to interest rate changes, affecting their attractiveness and stock prices.

Making the Choice: Factors to Consider

Investment Goals

- Income Needs: If immediate income is necessary, income investing may be more suitable.

- Growth Objectives: For long-term wealth building, dividend growth investing aligns better.

Risk Tolerance

- Low Risk Appetite: Dividend growth investing offers stability with lower risk.

- Higher Risk Acceptance: Income investing might involve higher risk for higher immediate returns.

Time Horizon

- Long-Term Horizon: Dividend growth investing benefits those who can invest for many years.

- Short-Term Needs: Income investing suits those with shorter time frames.

Market Knowledge

- Research Requirements: Dividend growth investing requires analysis of company fundamentals and growth prospects.

- Monitoring: Income investing may require vigilant monitoring of dividend sustainability.

Conclusion

Both Dividend Growth Investing and Income Investing offer unique advantages and challenges. Dividend Growth Investing is ideal for those seeking long-term growth and a rising income stream, with the patience to let compounding work its magic. Income Investing caters to individuals needing immediate income, willing to accept higher risk for higher yields.

When choosing between the two, consider your financial goals, risk tolerance, and investment horizon. A balanced approach might even involve incorporating elements of both strategies, tailoring a portfolio that meets both growth and income needs.

Remember, no investment strategy is without risk. Diligent research, diversification, and possibly consulting with a financial advisor can help navigate the complexities of dividend investing. Ultimately, aligning your investment approach with your personal financial objectives is the key to building a successful portfolio.

Final Thoughts

In an ever-changing economic landscape, dividend-focused investing remains a compelling strategy. Whether you opt for the steady growth of Dividend Growth Investing or the immediate returns of Income Investing, understanding the intricacies of each can empower you to make decisions that enhance your financial well-being.